Tax Sales

Purchasing A Tax Sale Property

To bid on a tax sale property, the following 5 steps must be completed:

- Determine your bid amount, which must be greater than the minimum tender amount

- Complete Form 7- Tender to Purchase

- Obtain a money order, bank draft, or certified cheque of at least 20% of your bid amount

- Insert your completed Form 7 and bid deposit in a sealed envelope with the required information. The sealed envelope must be addressed to the Treasurer, must indicate that it is for a tax sale, and must provide a short description or municipal address of the land sufficient to identify the parcel of land to which the tender relates.

- Submit your tender in person at our office or mail to, 28 Midlothian Road, RR1, Burks Falls ON P0A 1C0. The submission must be received prior to the closing date and time.

Frequently Asked Questions

For answers to some frequently asked questions regarding the tax sale process, please refer to the OTS website.

Please also refer to OREG 181/03 for a review of the legislation governing the tax sale process.

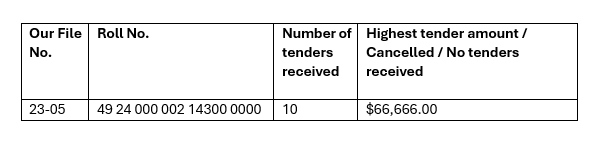

Current Tax Sales